For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax. The ruling sets out the sources of interest income which include.

Of course there are dividends or benefits that are tax-exempt such as Tabung Haji ASB or Unit Amanah.

. As working capital in its manufacturing business. Negotiable Instruments of Deposit. The company closes its account on 31 December every year.

The interest expense of RM100000 is allowed as a deduction from the gross business income of the company as it was incurred in the production of that income. Any amount deducted as TDS can be verified with Form 26AS. RM54400 RM1500 RM52900 Total Taxable Income Tax Exemption Chargeable Income.

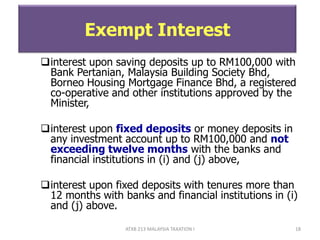

The company has not generated any income from the plantation activity. Interest which accrues in respect of any fixed deposits account including negotiable certificates of deposits of up to rm100000 for a period not exceeding twelve months withbank pertanian malaysia bank kerjasama rakyat malaysia bhg bank simpanan nasional borneo housing mortgage finance bhd malaysia building society bhd or a bank of. And Debt securities eg.

Financial Deposit Product including fixed deposit and savings accounts. Manufacturers of pharmaceutical products including vaccines investing in Malaysia Applications received by 31122022 Income tax rate of 0 up to 10 for first 10 years and at 10 for subsequent 10 years. Inland Revenue Board of Malaysia If you receive a dividend that is calculated as income youll be taxed because of the dividend earned.

Nik received interest income on 1 March 2015 from fixed deposits which were placed with a local bank. 14 Income remitted from outside Malaysia. However if you dont submit your PAN card TDS 20 is deducted on your interest income.

And fixed deposit in several banks. Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. Bonds that are i owned by a partnership or ii inventory of a trading business.

To calculate income tax on interest on fixed deposit you need to add your interest income to the total income which is then taxed as per slab rates applicable to you. Things like parking and childcare allowances which fall under Perquisites above can also be exempted from tax. It has no other investments as reflected in the companys balance sheet.

This limit has been increased to Rs 40000 in Budget 2019. The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable. Fixed Deposit FD Fixed deposit FD also known as term deposit is one of Malaysias most popular low-risk investments.

This means that the interest income is taxable even though the interest has not been received yet. It is an investment account where you agree to keep your money in the account for a fixed period usually between one and five. Gains or profits from savings accounts and investments with Islamic banks which are treated as interest for tax purposes.

Import duty sales tax exemption for machineries equipment and raw materials. Interest received from certain types of bonds or securities is also exempt from tax. Interest income Interest income accruing in or derived from Malaysia or received in Malaysia from outside Malaysia is subject to CIT.

Interest from the refund of excess employees CPF contributions. This type of income is excluded from counting as your taxable income. Since a fixed deposit interest is deemed a tax exemption and you dont have any tax relief at the moment we will talk more about tax relief and tax exemption later the calculation would look like this.

Nik also received dividends from a company listed on the Hong Kong Stock Exchange and insurance proceeds from an endowment policy. Specifically any interest earned from the following institutions is tax-free. For example if you take up a job while overseas and you only receive the payment for the job when you are back in.

The company incurred interest of RM100000 in the year 2009. Interest paid to a non-resident individual by commercial banks merchant banks or finance companies operating in Malaysia is exempt. Even though the income of Sawit Sdn Bhd is 100 derived from the saving in.

Debentures mortgages and loans. Interest Income Savings and Fixed Deposit from a Malaysian Bank P2P Lending Activities in Malaysia Lending to Steve Ma Sdn Bhd. 7 Nik is Malaysian tax resident and is employed by ABC Sdn Bhd.

1st RM 70000 RM 2800 The remaining RM 5000 RM 21 RM 1050. A bank or finance company licensed under the Banking and Financial Institutions Act 1989. This is because they offer guaranteed returns and are backed by the Malaysian government.

Reporting interest You must declare the full amount of your taxable interest. Exemptions granted include interest income earned by a non-resident person from deposits placed in designated financial institutions in Malaysia. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

In year 2014 the company receives interest amounting to RM10000 from the fixed deposit. Interest must be treated as being received by a person at the time when the person is entitled to the interest income accruing in or derived from Malaysia and is able to obtain the receipt thereof on demand Section 291 of the MITA. The rate of tax deduction at source is 10 if the income from interest for each year exceeds Rs 10000.

33 Taxable income and rates 34 Capital gains taxation 35 Double taxation relief 36 Anti -avoidance rules 37 Administration 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other withholding taxes 50 Indirect taxes 51 Goods and services tax 52 Capital tax. If employers provide loans to the employees there will be tax on the interest. A savings account is probably the most basic form of investment we can have and yes the interest we earn from our bank accounts is tax-free.

Deduction from Personal Relief 20000 Total Taxable Income.

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Taxation Principles Dividend Interest Rental Royalty And Other So

In The Matter Of Interest Crowe Malaysia Plt

Personal Income Tax Interest Income Tax Treatment

Income Tax Testbankanssss Pdf Tax Deduction Taxpayer

Does It Make Sense For Nris To Invest In Bank Fixed Deposits Scripbox

Taxation Principles Dividend Interest Rental Royalty And Other So

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account

Chapter 5 Non Business Income Students

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Taxation Principles Dividend Interest Rental Royalty And Other So

Analyzing A Bank S Financial Statements

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Taxation Principles Dividend Interest Rental Royalty And Other So